Types of charts

There are three most commonly used types of charts: line chart, bar chart and candlestick chart. It is optional for a trader what chart type to use.

Line chart contains price's closing value at given time. Values are then connected in one line, which creates a picture / graph of price fluctuations.

Below is an example of a line chart:

Bar charts are also called OHLC (HLC) charts. An abbreviation "OHLC" stays for OPEN, HIGH, LOW and CLOSE.

Each segment of these charts — a bar — provides a trader with additional information such as high and low ask prices and also open and close prices for certain period of time. In other words, the whole trading range can be observed.

Here is a sketch of a bar:

The whole chart also becomes more informative.

Candlestick charts are an improved version of bar charts. It is Forex most popular and widely used chart type. And we are going to discover why.

Each bar of the chart is a candlestick, known also as Japanese candlestick (it was invented by Japanese). Because of its appearance candlestick delivers more information than any other line or bar method.

First let's take a look at candlestick itself:

Candlestick carries HIGH, LOW, OPEN, CLOSE for the price and possess a BODY. A color and size of the body supply traders with additional price details.

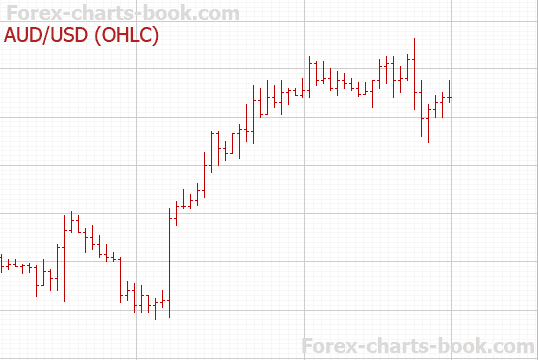

We are going to learn about different candlesticks later. Now let's take a general look at Forex candlestick chart:

This chart seems more alive and easier to apprehend visually. That's because a trader can quickly tell where the price went up, where it came down, when the price changed its direction and what happened there.

A candlestick chart reveals things that are not visible on other charts. It gives comprehensive information about price on the market and thus helps better understand and predict future price moves.

Sourcing:

http://www.forex-charts-book.com

0 comments :